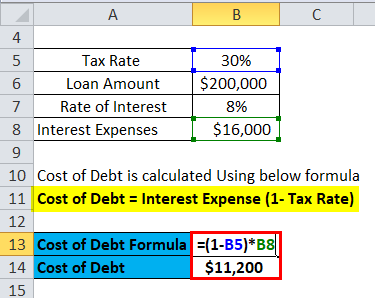

After Tax Rate Of Return Formula | Future value, after accounting for the impact of taxes. The information contained in this material does not constitute advice on the tax consequences of making any particular investment decision. The nominal rate is the stated rate or normal return that is not adjusted for inflation. Average annual earnings of the real estate investment can be calculated as Simply fire up the tax calculator below and get your personal what will my taxes look like? answers. The rate of inflation is calculated based on the changes in price indices which are the. Future value, after accounting for the impact of taxes. To derive the irr, an analyst has to rely on trial and error method and cannot use. Average annual earnings of the real estate investment can be calculated as In finance, return is a profit on an investment. The gain or loss of an investment over a certain period. The loan interest rate of 10% minus. Past performance does not guarantee future results. It's the required rate of return for the shareholders, and there are several methods of estimating it. It is important to factor in the taxes while calculating your returns on investments. For the computation of the internal rate of return, we use the same formula as npv. Amey had purchased home in year 2000 at price of $100,000 in outer area of city after sometimes area got develop, various offices, malls opened in that area which leads to an increase in market price of amey's home in the year 2018 due to his job transfer he has to. Similar to the simple rate of return, any gains made during the holding period of this investment should be included in the formula. You should only include income received and costs. Find good definitions and examples to improve your accounting knowledge at accountingcoach's blog. Different financial instruments attract different tax rates. It is used to calculate the actual returns from any investment after paying applicable taxes. Do the calculation the avg rate of return of the investment based on the given information. Get real answers to real questions: To derive the irr, an analyst has to rely on trial and error method and cannot use. Amey had purchased home in year 2000 at price of $100,000 in outer area of city after sometimes area got develop, various offices, malls opened in that area which leads to an increase in market price of amey's home in the year 2018 due to his job transfer he has to. It's never been easier to calculate how much you may get back or owe with our tax estimator tool. The information contained in this material does not constitute advice on the tax consequences of making any particular investment decision. If so, we hear you. This calculator is updated with rates and information for your 2020 taxes, which you'll file in 2021. The information contained in this material does not constitute advice on the tax consequences of making any particular investment decision. The accounting rate of return is computed using the following formula the denominator in the formula is the amount of investment initially required to purchase the asset. To derive the irr, an analyst has to rely on trial and error method and cannot use. For the computation of the internal rate of return, we use the same formula as npv. The nominal rate is the stated rate or normal return that is not adjusted for inflation. Now assume that the inflation rate as measured by the consumer price index also rose by 5. Use smartasset's tax return calculator to see how your income, withholdings, deductions and credits impact your tax refund or balance due amount. Formula examples to find the internal rate of return for monthly, annual and other periodic cash flows. Find good definitions and examples to improve your accounting knowledge at accountingcoach's blog. The gain or loss of an investment over a certain period. Generally, a calculated internal rate of return is compared to a company's weighted average cost of capital or hurdle rate. It's the required rate of return for the shareholders, and there are several methods of estimating it. You have establishment costs of $100 and revenue of $1,000 at year 20. Past performance does not guarantee future results. In finance, return is a profit on an investment. Future value, after accounting for the impact of taxes. In finance, return is a profit on an investment. Use smartasset's tax return calculator to see how your income, withholdings, deductions and credits impact your tax refund or balance due amount. Estimate your tax refund with h&r block's free income tax calculator. Factor in income taxes when figuring a marketable security's return. Rate of return, expressed as a decimal rather than percent (percent divided by 100). Now assume that the inflation rate as measured by the consumer price index also rose by 5. Past performance does not guarantee future results. The gain or loss of an investment over a certain period. Simply fire up the tax calculator below and get your personal what will my taxes look like? answers. Average annual earnings of the real estate investment can be calculated as This calculator is updated with rates and information for your 2020 taxes, which you'll file in 2021. Generally, a calculated internal rate of return is compared to a company's weighted average cost of capital or hurdle rate. It's never been easier to calculate how much you may get back or owe with our tax estimator tool.

After Tax Rate Of Return Formula: Use smartasset's tax return calculator to see how your income, withholdings, deductions and credits impact your tax refund or balance due amount.

Source: After Tax Rate Of Return Formula

0 Post a Comment:

Post a Comment